‘No signature, no seal’: Indian Law Ministry twice refused to serve US SEC summons to Gautam Adani and his nephew Sagar Adani

The Indian Law Ministry twice refused to formally serve the summons issued by the US Securities and Exchange Commission (SEC) on businessman Gautam Adani and his nephew Sagar Adani. The Law Ministry cited the absence of an ink signature, official seal and a technical objection as reasons behind the refusal on two occasions, Indian Express reported on 24th January 2026. The first refusal came in May 2025, and the second in December 2025. This led the US SEC to approach a New York federal court to bypass standard international service procedures and serve an “effective” summons to Gautam and Sagar Adani via email. After the news of the US market regulator seeking to send summons to the Adanis emerged, the Adani Group’s listed stocks dropped between 3.3% and 14.6% or cumulatively Rs 1 lakh in market capitalisation on Friday (24th January 2026). In its request filed before a New York federal court, the US SEC said, “Given the Ministry’s position, and the time elapsed since service was first attempted pursuant to the Hague Convention, the SEC does not expect service to be completed through the Hague Convention.” The bribery case against Gautam Adani, nephew Sagar Adani and other Adani Group executives It must be recalled that back in November 2024, the US SEC accused the Adanis of violating the “antifraud provisions of the federal securities laws by knowingly or recklessly making false and misleading representations concerning Adani Green Energy Ltd in connection with a September 2021 debt offering by Adani Green.” U.S. prosecutors charged Gautam Adani, his nephew Sagar Adani, and several executives from the Adani Group with orchestrating a $250 million bribery scheme to secure solar power project contracts in India. The indictment includes securities and wire fraud accusations, alleging that Gautam Adani, Sagar R Adani, and Vneet S Jaain misled U.S. investors about their anti-bribery policies while engaging in corruption. The Adani Group had denied all the allegations back then. The indictment also accused them of obstructing FBI, DOJ, and SEC investigations. Then US Attorney Breon Peace alleged they undermined global financial markets. The charges were presented against them by Breon Stacey Peace, who was the 48th United States Attorney for the Eastern District of New York. OpIndia reported earlier that Breon Peace had a connection to George Soros, hinting at a larger conspiracy to yet again damage the Indian industrialist’s reputation and business. Alongside the criminal case, the US SEC is also pursuing a civil lawsuit against the Adanis for allegedly violating the securities laws. After the US Justice Department indicted Gautam Adani in November 2024, the Adani Group withdrew the $ 600 million bond offering. Why did the Indian Law Ministry refuse the US SEC summons issued in February and December 2025 against Gautam Adani? The US Securities and Exchange Commission made its first formal request to the Indian Law Ministry in February 2025, seeking assistance under the Hague Convention on the Service Abroad of Judicial and Extrajudicial Documents in Civil or Commercial Matters. At that time, the Indian Law Ministry denied the request, citing the absence of an ink signature on the cover letter of the SEC, in addition to a missing seal on the required forms. “It is observed that the forwarding letter bears no seal & signature, and the Model Form bears no seal of the requesting authority as well. Hence, this Department is unable to verify and confirm the authenticity of the documents/Request, and therefore, the Documents are being returned to you for necessary action,” the ministry told the US SEC. In December 2025, the Indian Law Ministry denied the service of summons, citing US laws and also raised doubt over the applicability of the Hague Convention in this issue. The letter cited by the Indian Express report reads, “The documents have been checked and in view of the Rule 5(b) of the Securities and Exchange Commission (SEC)’s Informal and Other Procedures, 17 C.F.R. § 202.5(b), it is found that the above mentioned summon does not cover in the above said categories. Therefore, the same is returned herewith.” The Law Ministry further listed what actions the SEC can take during or otherwise. “After investigation or otherwise the Commission may in its discretion take one or more of the following actions: Institution of administrative proceedings looking to the imposition of remedial sanctions, initiation of injunctive proceedings in the courts, and, in the case of a willful violation, reference of the matter to the Department of Justice for criminal prosecution. The Commission may also, on some occasions, refer the matter to, or grant requests for access to its files made by, domestic and foreign governmental authorities or foreign securities authorities, self-regulatory organizations such as stock exchanges or the National Association of Securities Dealers, Inc.,

The Indian Law Ministry twice refused to formally serve the summons issued by the US Securities and Exchange Commission (SEC) on businessman Gautam Adani and his nephew Sagar Adani. The Law Ministry cited the absence of an ink signature, official seal and a technical objection as reasons behind the refusal on two occasions, Indian Express reported on 24th January 2026.

The first refusal came in May 2025, and the second in December 2025. This led the US SEC to approach a New York federal court to bypass standard international service procedures and serve an “effective” summons to Gautam and Sagar Adani via email.

After the news of the US market regulator seeking to send summons to the Adanis emerged, the Adani Group’s listed stocks dropped between 3.3% and 14.6% or cumulatively Rs 1 lakh in market capitalisation on Friday (24th January 2026).

In its request filed before a New York federal court, the US SEC said, “Given the Ministry’s position, and the time elapsed since service was first attempted pursuant to the Hague Convention, the SEC does not expect service to be completed through the Hague Convention.”

The bribery case against Gautam Adani, nephew Sagar Adani and other Adani Group executives

It must be recalled that back in November 2024, the US SEC accused the Adanis of violating the “antifraud provisions of the federal securities laws by knowingly or recklessly making false and misleading representations concerning Adani Green Energy Ltd in connection with a September 2021 debt offering by Adani Green.”

U.S. prosecutors charged Gautam Adani, his nephew Sagar Adani, and several executives from the Adani Group with orchestrating a $250 million bribery scheme to secure solar power project contracts in India. The indictment includes securities and wire fraud accusations, alleging that Gautam Adani, Sagar R Adani, and Vneet S Jaain misled U.S. investors about their anti-bribery policies while engaging in corruption. The Adani Group had denied all the allegations back then.

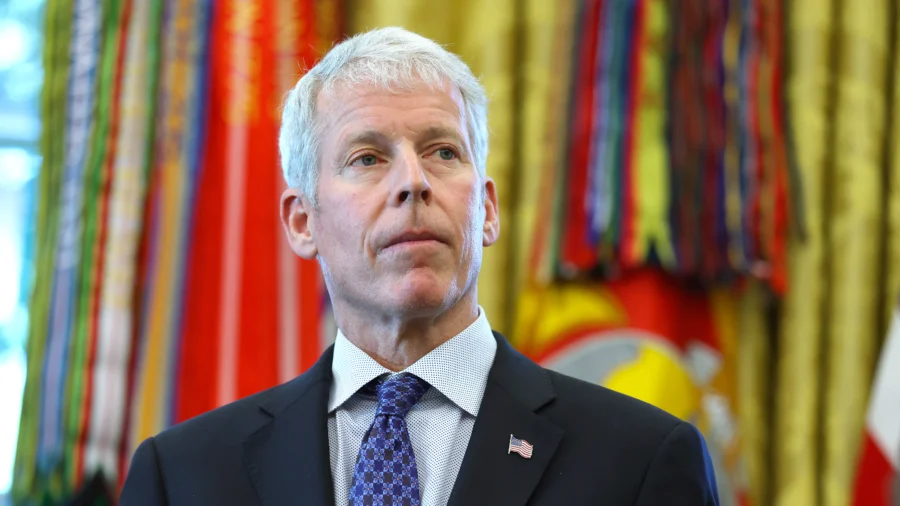

The indictment also accused them of obstructing FBI, DOJ, and SEC investigations. Then US Attorney Breon Peace alleged they undermined global financial markets.

The charges were presented against them by Breon Stacey Peace, who was the 48th United States Attorney for the Eastern District of New York. OpIndia reported earlier that Breon Peace had a connection to George Soros, hinting at a larger conspiracy to yet again damage the Indian industrialist’s reputation and business.

Alongside the criminal case, the US SEC is also pursuing a civil lawsuit against the Adanis for allegedly violating the securities laws.

After the US Justice Department indicted Gautam Adani in November 2024, the Adani Group withdrew the $ 600 million bond offering.

Why did the Indian Law Ministry refuse the US SEC summons issued in February and December 2025 against Gautam Adani?

The US Securities and Exchange Commission made its first formal request to the Indian Law Ministry in February 2025, seeking assistance under the Hague Convention on the Service Abroad of Judicial and Extrajudicial Documents in Civil or Commercial Matters.

At that time, the Indian Law Ministry denied the request, citing the absence of an ink signature on the cover letter of the SEC, in addition to a missing seal on the required forms.

“It is observed that the forwarding letter bears no seal & signature, and the Model Form bears no seal of the requesting authority as well. Hence, this Department is unable to verify and confirm the authenticity of the documents/Request, and therefore, the Documents are being returned to you for necessary action,” the ministry told the US SEC.

In December 2025, the Indian Law Ministry denied the service of summons, citing US laws and also raised doubt over the applicability of the Hague Convention in this issue. The letter cited by the Indian Express report reads, “The documents have been checked and in view of the Rule 5(b) of the Securities and Exchange Commission (SEC)’s Informal and Other Procedures, 17 C.F.R. § 202.5(b), it is found that the above mentioned summon does not cover in the above said categories. Therefore, the same is returned herewith.”

The Law Ministry further listed what actions the SEC can take during or otherwise. “After investigation or otherwise the Commission may in its discretion take one or more of the following actions: Institution of administrative proceedings looking to the imposition of remedial sanctions, initiation of injunctive proceedings in the courts, and, in the case of a willful violation, reference of the matter to the Department of Justice for criminal prosecution. The Commission may also, on some occasions, refer the matter to, or grant requests for access to its files made by, domestic and foreign governmental authorities or foreign securities authorities, self-regulatory organizations such as stock exchanges or the National Association of Securities Dealers, Inc., and other persons or entities.”

In its court filing, the US SEC interpreted it as the Indian Law Ministry telling them that the SEC “lacks authority to invoke the Hague Convention or seek service of the Summonses.”

Consequently, now the US SEC is seeking a federal court approval to use an alternative, email service of summons to the Adanis, bypassing the Indian government.

Adani Green Energy says SEC proceedings “civil in nature”, company not party to the legal proceedings

On Friday (23rd January 2026), Adani Green Energy stated in its stock exchange filing that the company is not a party to the ongoing legal proceedings, nor has it been charged. It reiterated that the SEC proceedings are “civil in nature”.

“The Company is not a party to these proceedings, and no charges have been brought against it. Further, as clarified in our intimation to the stock exchanges dated November 27, 2024 (1:16:32hrs), the Defendants have not been charged with violation/(s) of the United States Foreign Corrupt Practices Act i.e. there are no charges of bribery or corruption against the Defendants. The SEC proceedings are civil in nature,” Adani Green Energy stated.

This statement came in response to the queries raised by the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) regarding the news about the US SEC seeking to issue summons to Gautam and Sagar Adani.